do you have to pay taxes on fanduel winnings|How to Pay Taxes on Sports Betting Winnings & Losses : Tuguegarao Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax . Pick the odd man out KML PRQ NPQ TVU 11. From the given choices select the odd one out. PSRQ MNPO SVUT KNML 12 choose the odd man out TRIANGLE SQUARE PENTAGON CIRCLE 13. find the given anagrams select the odd one out LABLOTOF ONSEL CEKTRIC D SNINET 14 . choose the odd man out: HAIR LIAR FIAR PAIR 15 .

do you have to pay taxes on fanduel winnings,Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax . Learn how to report your FanDuel winnings on your taxes, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how to .

Fanduel operates under the guidelines of the Internal Revenue Service (IRS). They issue a 1099-Misc tax form for winnings over $600. However, if you win . Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a .The requirement to report FanDuel winnings on taxes depends on several factors, including the nature of the winnings and the specific regulations of your jurisdiction. Generally .

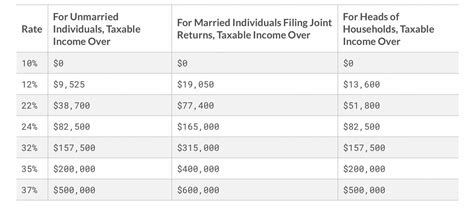

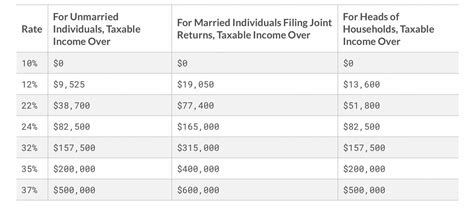

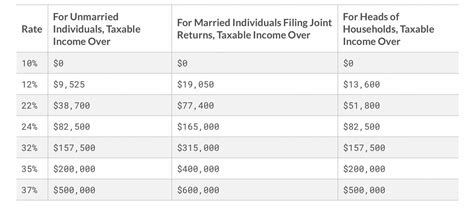

Transparent pricing. Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees. Maximum refund guaranteed. Get every dollar you deserve* when . Yes, but you can never write off more than you've won and to do so you must itemize your deductions, unless you bet for a living. So if you won $1,000 at . OVERVIEW. Fantasy sports leagues can yield hefty winnings if Lady Luck smiles on you. If you win big—or even not so big—you'll need to save a portion of that .DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do .You can also customize and view certain months throughout the years or by app and product. This statement is not a tax document. You can read much more about taxes .How to Pay Taxes on Sports Betting Winnings & Losses No. The tax implications differ considerably between these two categories. For professional gamers, Fanduel winnings are considered regular income. This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021.

Luckily for you, we have put together this very simple, easy-to-use, free gambling winnings tax calculator. Select your state on the calculator, select your relationship status, add in your taxable income, . Luckily for you, we have put together this very simple, easy-to-use, free gambling winnings tax calculator. Select your state on the calculator, select your relationship status, add in your taxable income, .

do you have to pay taxes on fanduel winnings Luckily for you, we have put together this very simple, easy-to-use, free gambling winnings tax calculator. Select your state on the calculator, select your relationship status, add in your taxable income, .You may need to report your winnings even if you do not receive a W-2G and if nothing is withheld. FanDuel does not provide tax or accounting advice. This material has been prepared for informational purposes only, . Massachusetts taxes ordinary income at 5%. This means there is not a set gambling tax rate in MA. It will be treated differently than your income, but the rate will depend on your overall taxable income. You should keep any documentation you receive from a sportsbook, especially pertaining to a loss.If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should also send both you and the IRS a tax form if your winnings exceed . Form W-2G. Both cash and the value of prizes are considered “other income” on your Form 1040.If you score big, you might even receive a Form W-2G reporting your winnings. The tax code requires institutions that offer gambling to issue Forms W-2G if you win:. $600 or more on a horse race (if the win pays at least 300 .Effective for tax years after 2017, the federal rate on winnings over $5,000 is 24%. Winnings under that benchmark of $5,000 must also be reported depending on their amounts and sources. Currently, Indiana’s personal income tax rate is 3.23%. Almost all gambling winnings are subject to this tax. How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel .Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting . Currently, there are no tax deductions for fantasy league winnings. Before 2018, you could write off the entrance fees under miscellaneous deductions. However, the tax laws changed under the Tax Cuts and Jobs Act and eliminated miscellaneous deductions like this one. Learn more: Need-to-Know Tax Reform.

do you have to pay taxes on fanduel winnings How to Pay Taxes on Sports Betting Winnings & Losses Do You Have to Pay Taxes on DraftKings, FanDuel, BetMGM, and Other Fantasy Sports Bets? If you are lucky to take home a net profit of $600 or more for the year playing on DraftKings, FanDuel, . According to an IRS publication on the subject, if you win more than $5,000, the casino or sportsbook may be required to withhold 28% of your winnings. Illinois has a 4.95% flat state income tax rate, and this is the percentage that would be withheld at the state level. For lottery winnings, they withhold the 4.95% if you win $1,000 or more.

The amount withheld is based on each winner’s total prize amount and the tax bracket. When they file their annual tax return, prize winners may also have to pay more taxes. Ohio State withholds a 4% tax on winnings exceeding $600. At the same time, the federal government takes out a tax rate ranging from 24% to 28% based on .There is a 15% tax rate if you earn $600 or more betting on sports in Illinois. This amount is cumulative over the course of the year. You should receive a Form W-2G from each sportsbook that paid out to you. Again, use the information on those forms to report your sports gambling winnings to the IRS and the state. Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through .While FanDuel winnings are generally considered taxable income, not all winnings may be subject to reporting depending on the amount won and the frequency of your gambling activities. Amount won: As mentioned earlier, the IRS has set a reporting threshold of $600 for gambling winnings. If your total winnings from FanDuel in a tax year exceed .

There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for .Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting .

do you have to pay taxes on fanduel winnings|How to Pay Taxes on Sports Betting Winnings & Losses

PH0 · Where can I see my Win/Loss or Player Activity Statement?

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes on Sports Betting: How They Work, What’s Taxable

PH3 · Taxes

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · TVG

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Sports Betting Taxes: How They Work, What's Taxable

PH8 · How to Pay Taxes on Sports Betting Winnings & Losses

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Do I Have To Report FanDuel Winnings On Taxes?